Texas Tax Rate 2025. 2025 individual income tax rate by state excluding those without income tax, no two states share identical rates and brackets. However, the total texas sales tax rate is capped at a maximum of 8.25% combined.

The federal federal allowance for over 65 years of age head of household filer in 2025 is $ 1,950.00. The following cities have increased the additional city sales and use tax for the purpose listed below:

General tax rate (gtr) replenishment tax rate (rtr) obligation assessment rate (oa) deficit tax rate (dtr) employment.

Calculated using the texas state tax tables and allowances for 2025 by selecting your filing status and entering your income for 2025 for.

Ranking Of State Tax Rates INCOBEMAN, General tax rate (gtr) replenishment tax rate (rtr) obligation assessment rate (oa) deficit tax rate (dtr) employment. The texas sales tax rate is 6.25% as of 2025, with some cities and counties adding a local sales tax on top of the tx state sales tax.

Tax rates for the 2025 year of assessment Just One Lap, The 6% commission, a standard in home purchase transactions, is no more. Texas residents state income tax tables for head of household filers in 2025.

Taxes By State 2025 Dani Michaelina, Calculated using the texas state tax tables and allowances for 2025 by selecting your filing status and entering your income for 2025 for. The federal federal allowance for over 65 years of age head of household filer in 2025 is $ 1,950.00.

What Are the Tax Rates in Texas? Texapedia, The texas state tax calculator (txs tax calculator) uses the latest federal tax tables and state tax tables for 2025/25. However, the total texas sales tax rate is capped at a maximum of 8.25% combined.

State Corporate Tax Rates and Key Findings What You Need to, Texas state tax quick facts. However, the total texas sales tax rate is capped at a maximum of 8.25% combined.

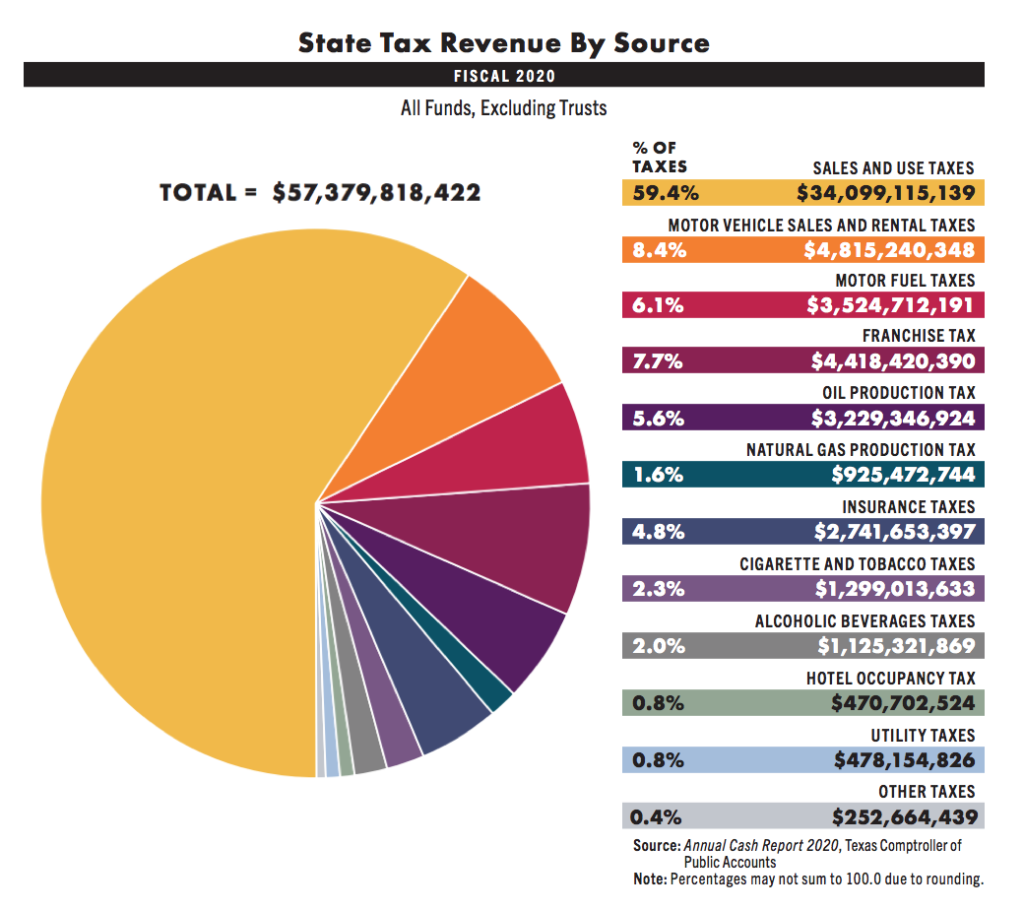

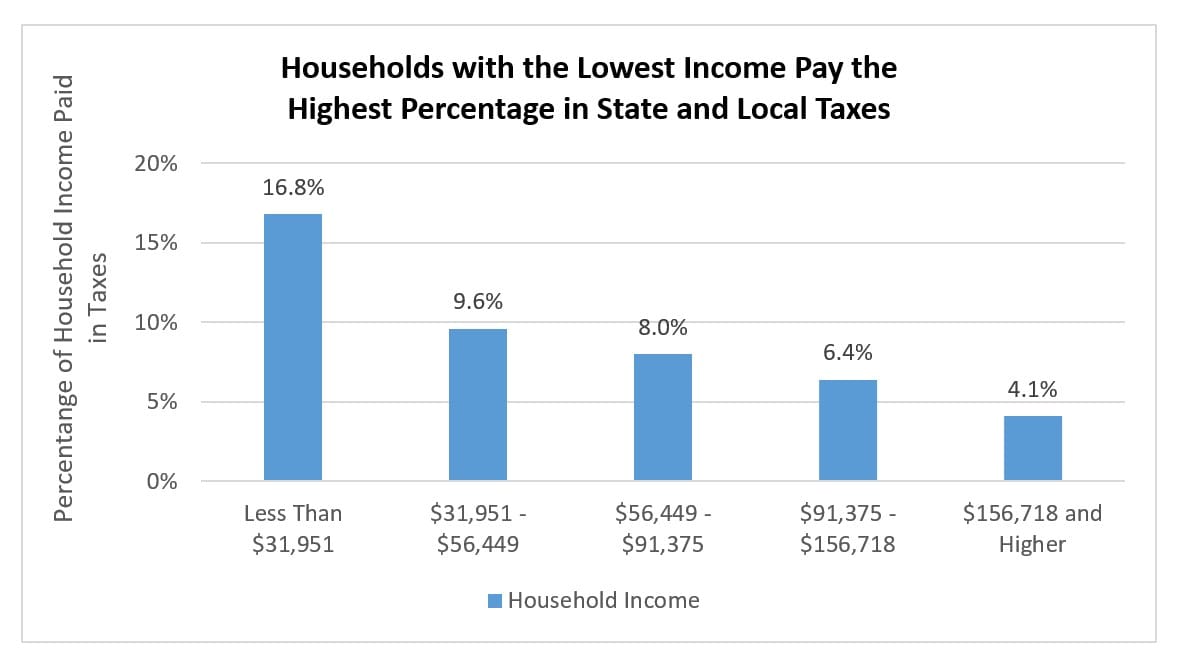

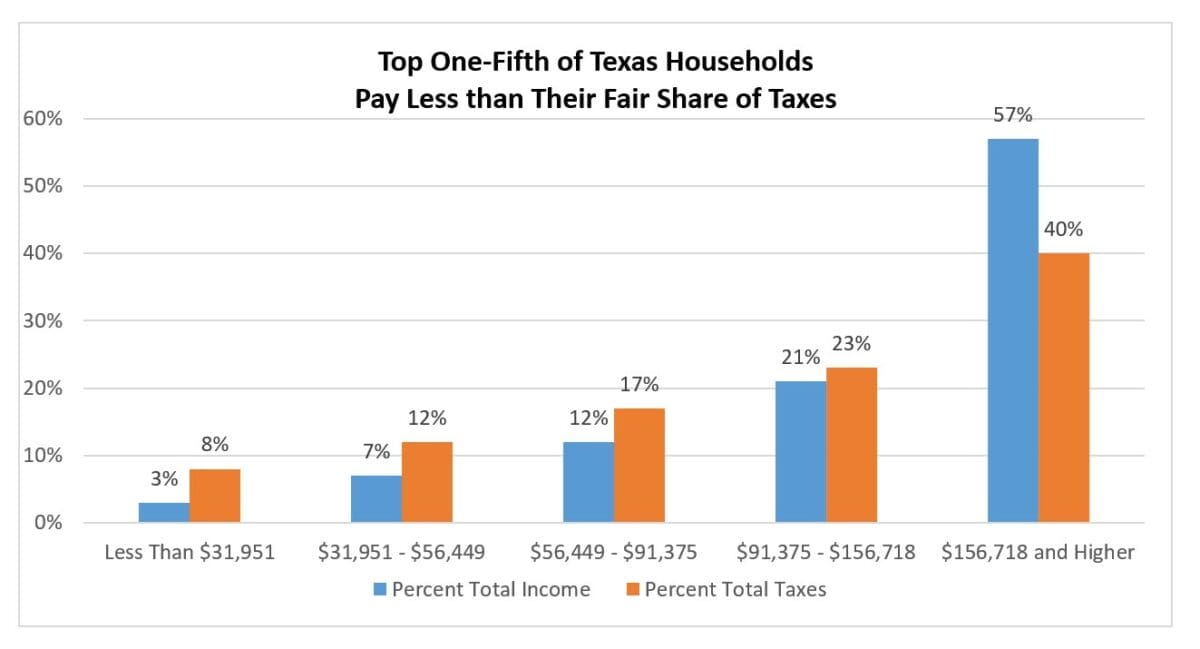

Who Pays Texas Taxes? Every Texan, Texas state income tax calculation: The texas franchise tax, which applies to most businesses operating in the state, will see changes to its rates in 2025.

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, Calculate your income tax, social security and. If you make $70,000 a year living in texas you will be taxed $7,660.

Tax Rates 2025 To 2025 2025 Printable Calendar, To estimate your tax return for 2025/25, please select the. General tax rate (gtr) replenishment tax rate (rtr).

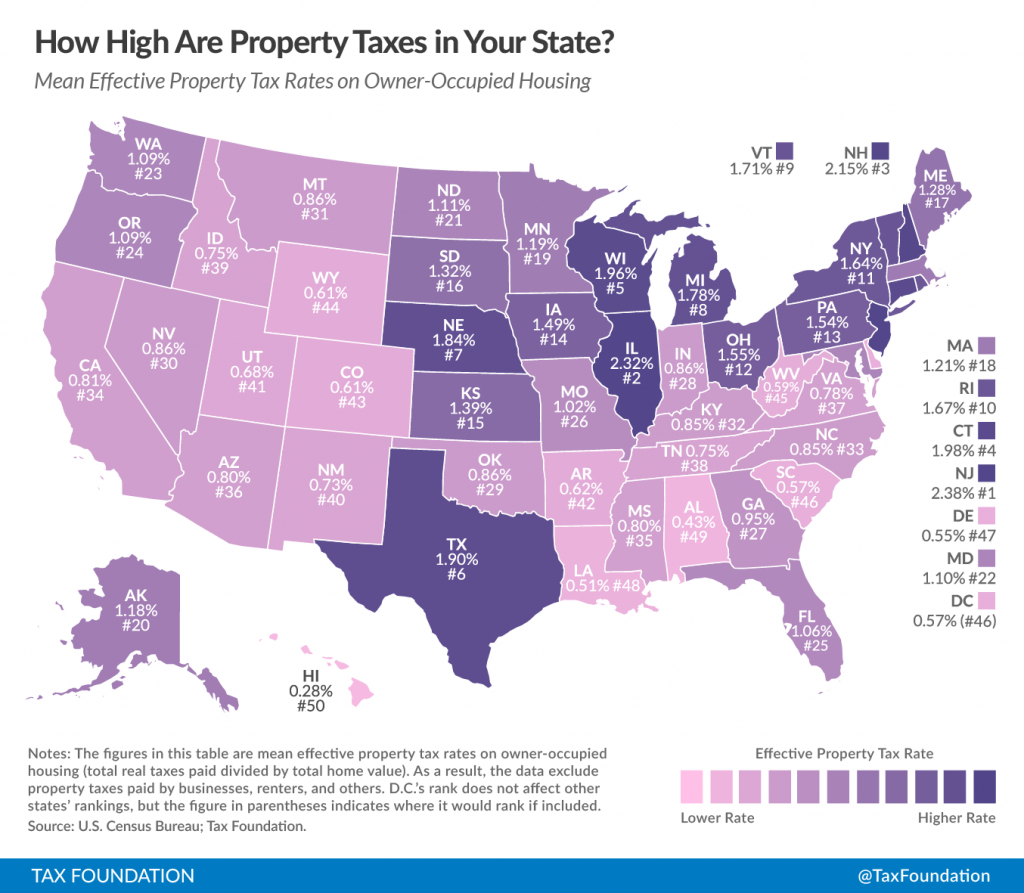

How High Are Property Taxes In Your State? Tax Foundation Texas, Calculate your annual salary after tax using the online texas tax calculator, updated with the 2025 income tax rates in texas. Exemptions to the texas sales tax will vary by.

Who Pays Texas Taxes? Every Texan, Texas state income tax calculation: Calculate your annual salary after tax using the online texas tax calculator, updated with the 2025 income tax rates in texas.