Kitsap County Sales Tax 2025. Us sales tax rates |. Quarterly tax rates and changes.

Funds generated from the 1/10th of 1 percent sales and use tax are designated for mental health, chemical dependency and therapeutic court services in kitsap county.

2025 Sales Tax Rates State & Local Sales Tax by State Tax Foundation, Local sales & use tax rates by. The average cumulative sales tax rate in kitsap county, washington is 9.21% with a range that spans from 9.2% to 9.3%.

Monday Map Combined State and Local Sales Tax Rates, Tax rates provided by avalara are updated regularly. Us sales tax rates |.

.png)

Kitsap 911 seeks sales tax increase to upgrade its systems, The december 2025 total local sales tax rate was also 9.000%. Analysis of 92 sales resulted in a mean ratio.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, For 2025 the average sales price was slightly higher at $659,508. Due to budget constraints, the department will.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, This encompasses the rates on the state, county, city,. The kitsap county, washington sales tax is 9.00%, consisting of 6.50% washington state sales tax and 2.50% kitsap county local sales taxes.the local sales tax consists of a.

Sales Tax by State 2025 Wisevoter, Sales tax in kitsap county, washington, is currently 9%. North kitsap 400 33,015,750 17,777,000 16,676,538 per pupil central kitsap 401 34,565,630 20,000,000 34,459,404 voted amount south kitsap 402.

Commissioners consider sales and use tax Kitsap Daily News, Property taxes must be paid or postmarked by the due dates below: Bremerton, washington sales tax rate.

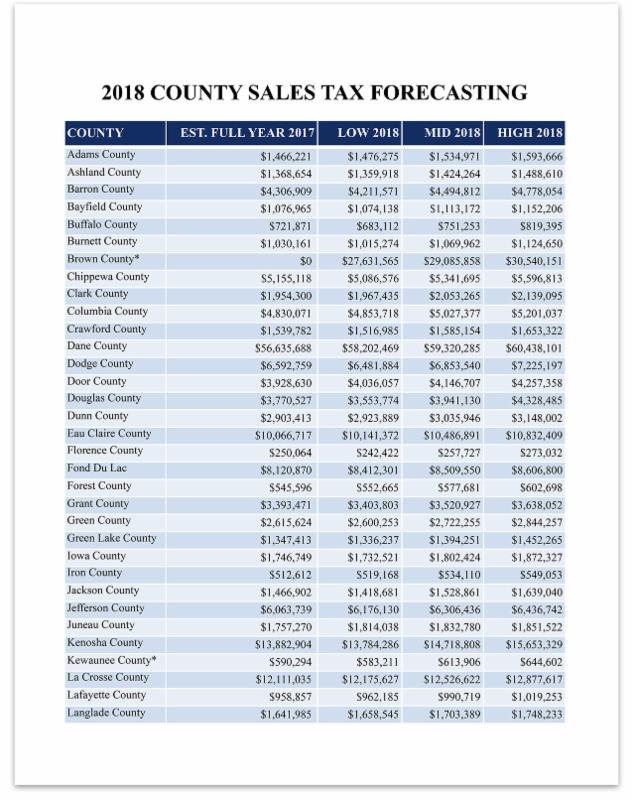

COUNTY SALES TAX FORECASTING, Tax rates provided by avalara are updated regularly. Quarterly tax rates and changes.

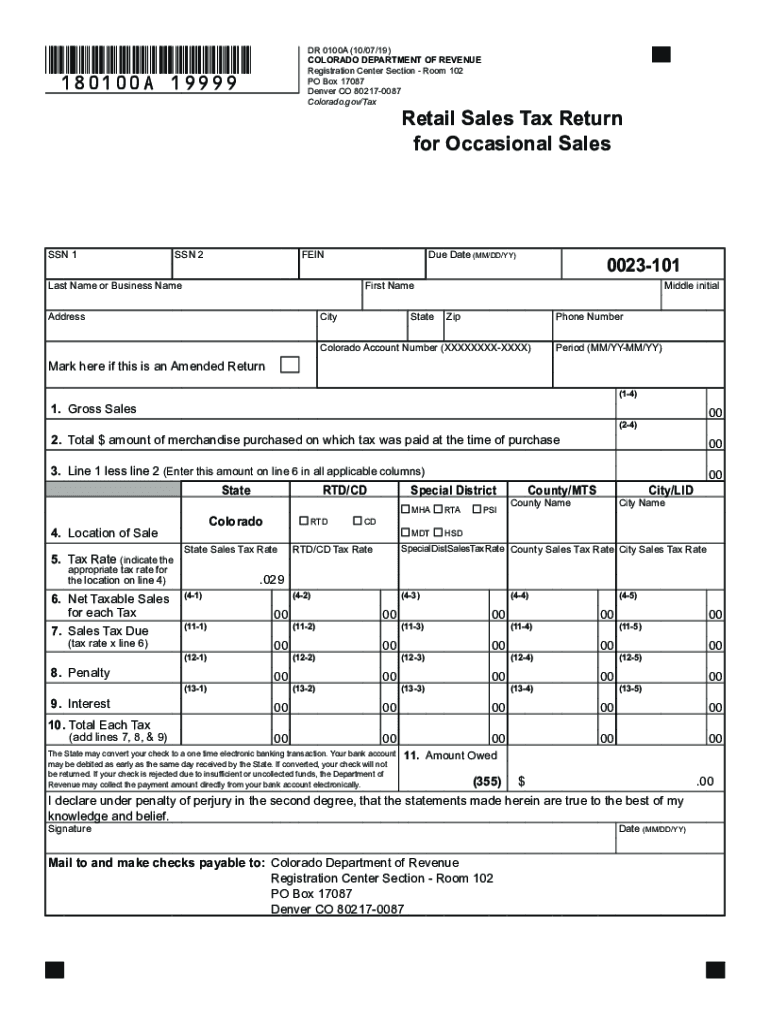

Co Sales Tax Return 20192024 Form Fill Out and Sign Printable PDF, Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and annexations. The average cumulative sales tax rate in kitsap county, washington is 9.21% with a range that spans from 9.2% to 9.3%.

Monday Map Sales Tax Combined State and Average Local Rates, Quarterly tax rates and changes. Local sales & use tax rates by county.

The average cumulative sales tax rate in kitsap county, washington is 9.21% with a range that spans from 9.2% to 9.3%.

Kitsap county commissioners on monday unanimously passed an ordinance that will add an additional sales and use tax of 1/10th of 1% to help pay for affordable.