Dependent Care Fsa Income Limit 2025 Over 50. Business news/ money / personal finance/ mother's day 2025: An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

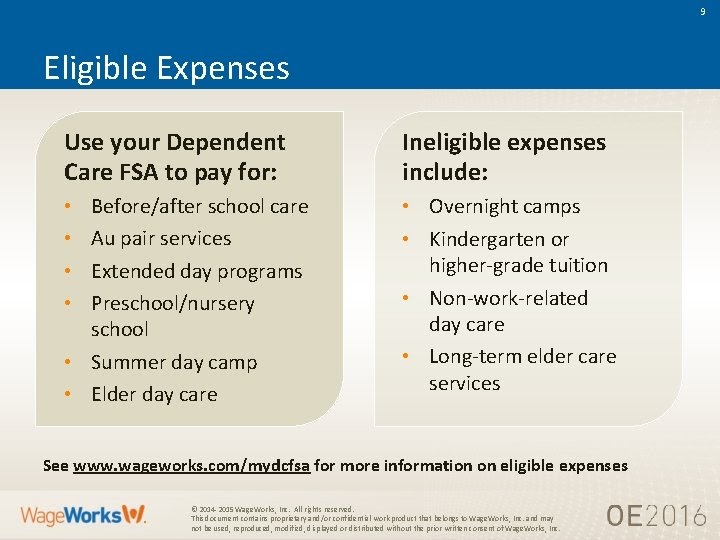

What is a dependent care fsa? Due to the irs “use it or lose it” rule, you will forfeit any money remaining in your 2025 dependent care fsa after december 31, 2025, if you.

Dependent care fsa limits for 2025 the 2025 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households.

The individual hsa contribution limit will be $3,850 (up from $3,650) and the family contribution limit will be $7,750 (up from $7,300).

Dependent Care Flex Spending Account — BPC Employee Benefits, $5,000 for individual or mfj, $2,500 for mfs: The individual hsa contribution limit will be $3,850 (up from $3,650) and the family contribution limit will be $7,750 (up from $7,300).

Dependent Care FSA vs. the Tax Credit Which is Better? The Sista Fund, $5,000 for individual or mfj, $2,500 for mfs A dependent care fsa (sometimes called a dcfsa) is a type of flexible spending account.

DEPENDENT CARE FSA WHAT YOU NEED TO KNOW Saving Joyfully Save My, Limit type 2025 limit 2025 limit; What is a dependent care fsa?

Is there an limit for dependent care credit? Leia aqui What is, The irs sets dependent care fsa contribution limits for each year. $5,000 for individual or mfj, $2,500 for mfs

2025 Dcfsa Limits 2025 Calendar, Your new spouse's earned income for the year was $2,000. These amounts are approximately 7% higher than the hsa contribution limits for 2025.

Dependent Care and Commuter Contribution Limits 2025 FSA Kona HR, Due to the irs “use it or lose it” rule, you will forfeit any money remaining in your 2025 dependent care fsa after december 31, 2025, if you. The irs does limit the amount of money you can contribute to a dcfsa each year.

Dependent Care Fsa Limit 2025 Everything You Need To Know, $5,000 for individual or mfj, $2,500 for mfs A dependent care fsa lets a household set aside up to $5,000 to pay child care expenses for kids under age 13.

Under the Radar Tax Break for Working Parents The Dependent Care FSA, Faqs about the child and dependent care credit expansion due to the arpa. The individual hsa contribution limit will be $3,850 (up from $3,650) and the family contribution limit will be $7,750 (up from $7,300).

/GettyImages-909224522-325f3040e86a4e6d86eb0767b2c44da9.jpg)

Dependent Care FSA We all spend time on finding ways to make money and, The dependent care fsa maximum, which is set by statute and not adjusted annually for inflation, is usually $5,000 a year for individuals or married couples filing. The dependent care fsa (dcfsa) maximum annual contribution limit did not change for 2025.

Dependent Care Flexible Spending Account (FSA) Definition, Your new spouse's earned income for the year was $2,000. These limits apply to both the calendar.

Max health care fsa contribution (per person/employee) dependent care fsa max election (married, family max) dependent care fsa max election (filing.