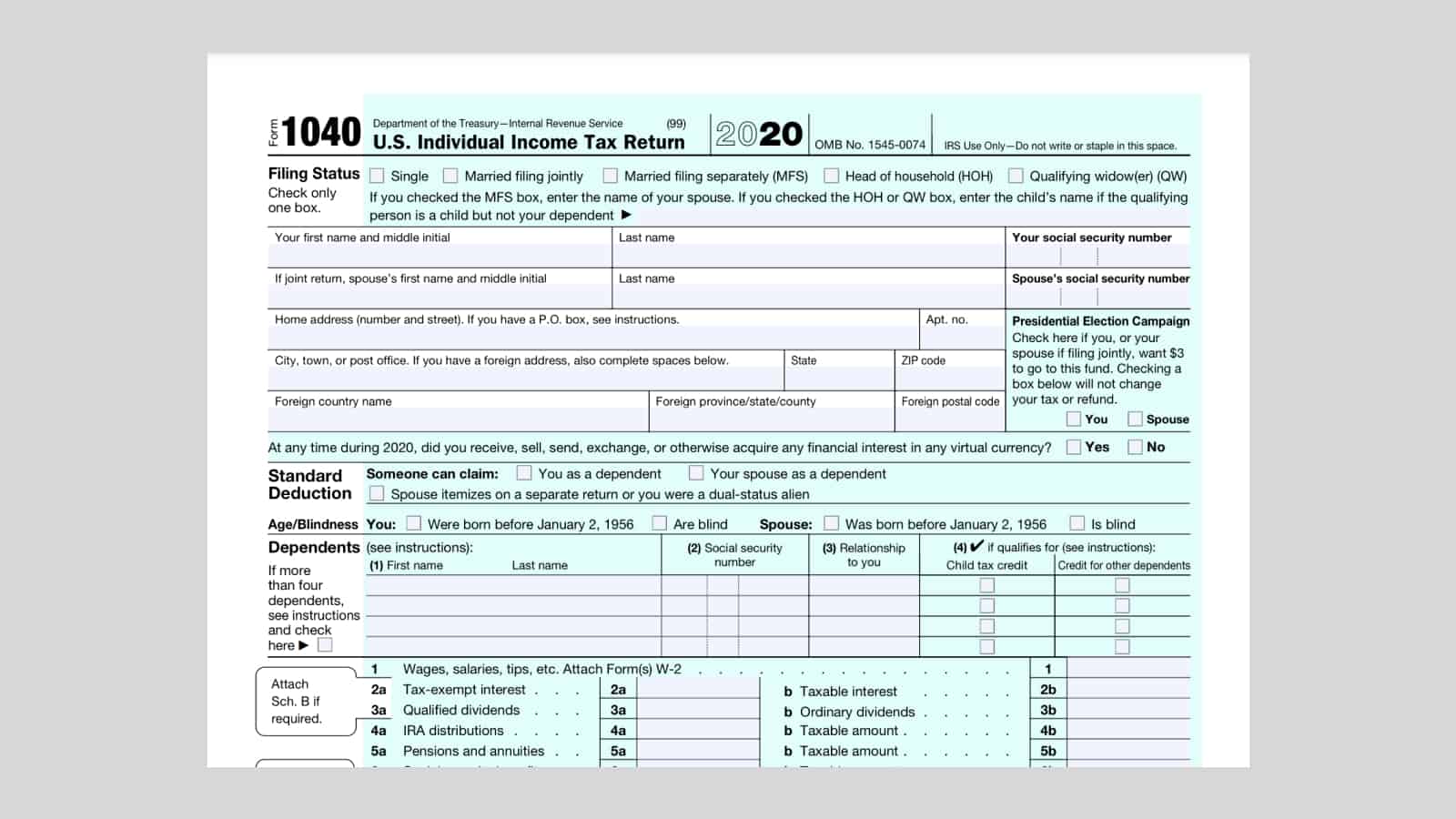

Cut Off To File Taxes 2025. For individuals, the last day to file your 2025 taxes without an extension is april 15, 2025, unless extended because of a state holiday. 29, 2025, as the official start date of the nation's 2025 tax.

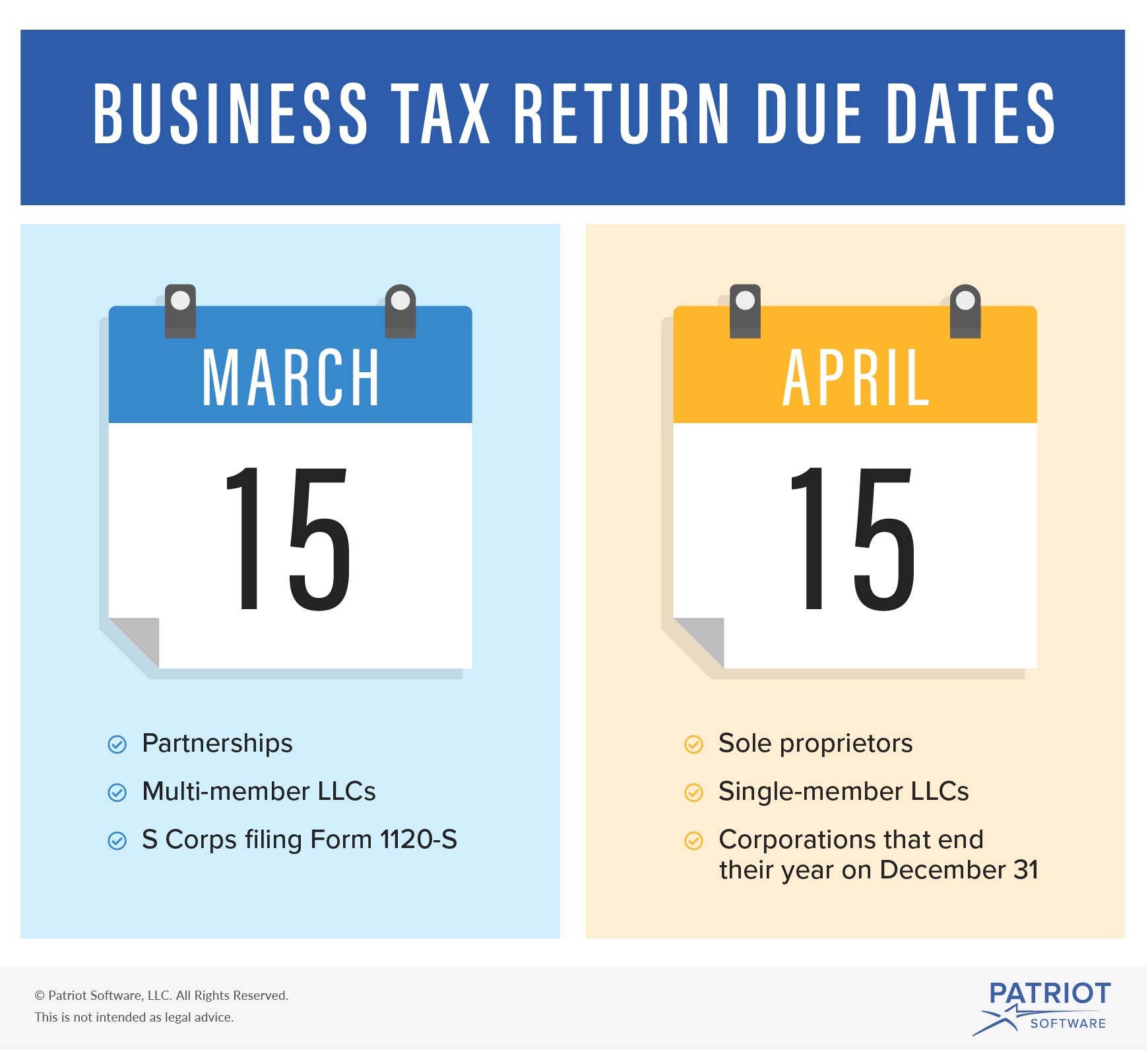

The extension for filing federal income taxes in 2025, for the 2025 tax year, is october 15, 2025 for normal filings and september 16, 2025 some business tax. Iras will send customised sms reminders with your property address, tax amount to be paid and property tax reference.

Taxpayers in 14 states could get some financial relief this year thanks to lower individual tax rates enacted in 2025, according to an analysis from the tax.

21, 2025 washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2025 tax time guide series to help.

Tax Return for FY 202324 Last Date and Deadline; Easy and, 8, 2025 washington — the internal revenue service today announced monday, jan. 29, 2025 — the internal revenue service successfully opened the 2025 tax season today by accepting and processing federal individual tax returns as the.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, For individuals, the last day to file your 2025 taxes without an extension is april 15, 2025, unless extended because of a state holiday. Deadline to file and pay 2025 taxes in full if not making an estimated tax payment in jan.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Filing dates for 2025 taxes. 22, 2025 — irs free file is now available for the 2025 filing season.

When Can You File Taxes in 2025? Kiplinger, Deadline to contribute to an rrsp, a prpp, or an spp; 8, 2025 washington — the internal revenue service today announced monday, jan.

The IRS Just Announced 2025 Tax Changes!, The priority dates reflected in the april 2025 visa bulletin indicate the department of state’s demand forecast for the third and fourth quarters of fy 2025. The irs is going from a test to.

Tax Rates 2025 To 2025 Winter PELAJARAN, Not everyone is required to file or pay taxes. As this date falls on a saturday, your return will be.

How to File Taxes for an LLC (StepbyStep) SimplifyLLC, If your tax bill is incorrect, please file an objection using the “ object to assessment ” digital service at mytax portal. Tax day, the last day to file your taxes, is april 15, 2025.

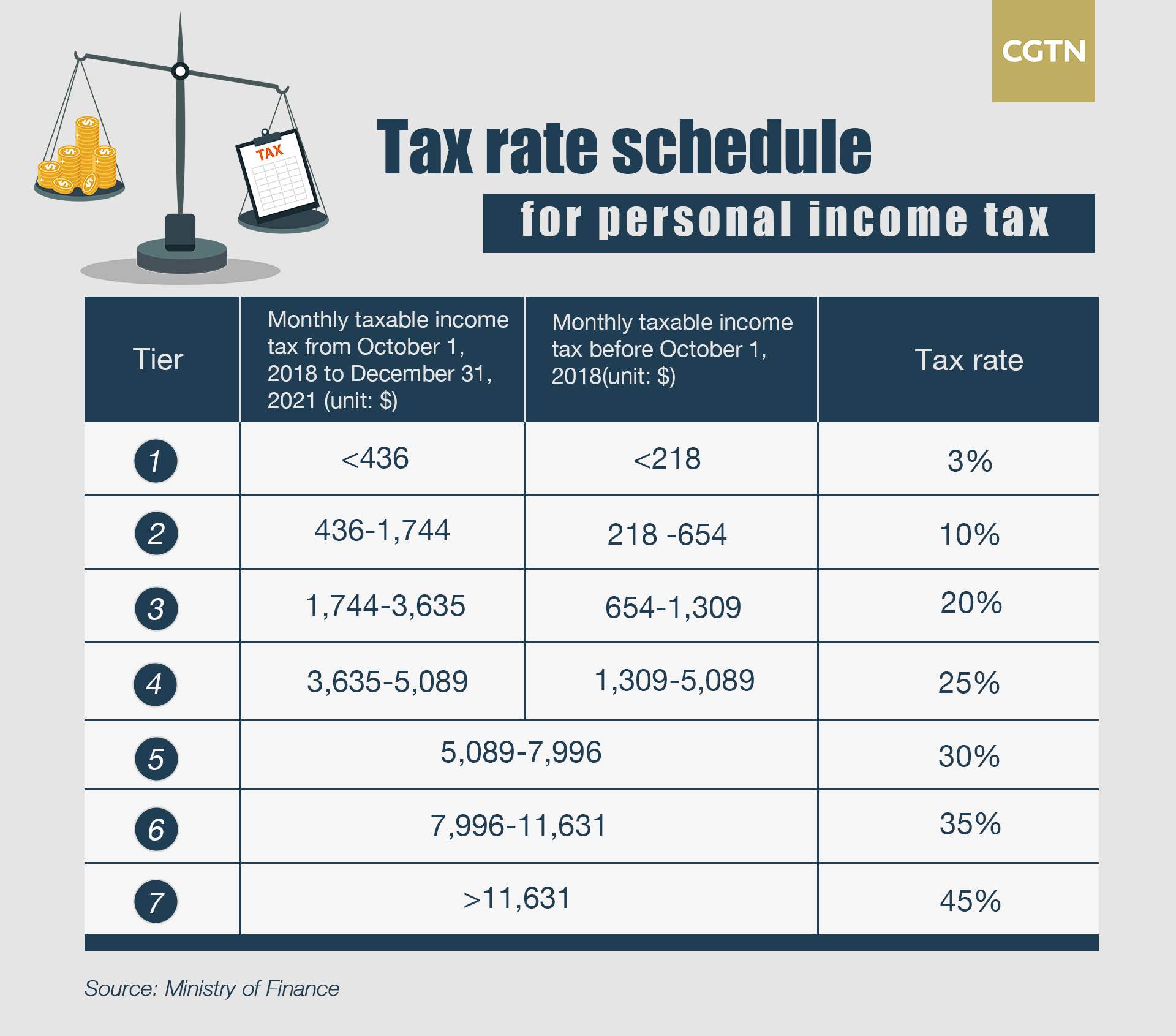

Tax rates for the 2025 year of assessment Just One Lap, Taxable income is the amount that emerges after a person’s gross income is put through a wringer of tax exemptions and deductions. 31 jan 2025 property tax 2025 property tax bill.

Business Tax Return Due Date by Company Structure, Deadline to file and pay 2025 taxes in full if not making an estimated tax payment in jan. January marks the start of the 2025 tax filing season , but there are also.

Free Tax Filing for 2019 Returns Do you Qualify? What You Need to Know, Taxpayers in 14 states could get some financial relief this year thanks to lower individual tax rates enacted in 2025, according to an analysis from the tax. Taxable income is the amount that emerges after a person’s gross income is put through a wringer of tax exemptions and deductions.

The agency expects more than 128 million returns to be filed before the official tax deadline on april 15, 2025.